putnam county property tax bill

100 South Jefferson Avenue Suite 207 Eatonton GA 31024 706-485-5441 Fax 706-485-2527 Pamela K. Putnam County Property Tax Inquiry.

Parcel Search Image Mate Online

Property Tax Statement Info.

. There are two major factors that influence the amount of real estate taxes you pay. Account info last updated on Jul 4 2022 0 Bills - 000 Total. View Cart Checkout.

Search Valuable Data On Properties Such As Liens Taxes Comps Foreclosures More. 3 penalty and advertising fee applies to unpaid real property taxes. Tax Rolls Rates.

2022 MANUFACTURED HOME Tax Due Dates. Any tax payer wishing. Ad Find County Property Tax Info For Any Address.

120 North 4th Street Hennepin IL 61327. About Contact Us. 40 Gleneida Ave Room 104.

Official Putnam County Illinois website features interactive maps for economic development government minutes agendas county departments. Putnam County Sheriffs Tax Office 236 Courthouse Drive Suite 8 Winfield WV 25213 304 586-0204. Start Your Homeowner Search Today.

Putnam County Sheriffs Tax Office 236 Courthouse Drive Suite 8 Winfield WV 25213 304 586-0204. Ad Pay Your Taxes Bill Online with doxo. Taxes must be paid by.

The 2021 City of Cookeville Property Tax Rate is 082 per 100 of assessed value. The County Finance Department performs the following functions. Taxes become delinquent April 1 of the.

View an Example Taxcard View all search methods. A property tax calculator is available to estimate the property tax due for any appraised value. In-depth Putnam County IN Property Tax Information.

Online Property Tax Payment Enter a search argument and select the search. Ad Get In-Depth Property Tax Data In Minutes. Instead contact this office by phone or in writing.

Changes occur daily to the content. Putnam Country Tax Assessors Office Website. Other taxes collected by the County Treasurer are Manufactured Home Inheritance and Special Assessments.

The Trustee acts as the countys banker and also collects county. You may begin by choosing a search method below. Property tax information last updated.

Putnam County Property Taxes become delinquent April 1 of the year of assessment at which time a 3 penalty is added to the real estate tax bill. The accuracy of the information provided on this website is not guaranteed for legal purposes. Exemptions and deductions are available in State of Indiana which may lower the propertys tax bill.

Revenue Bill Search Pay - Town of Putnam. Property Tax Calendar - Putnam County Illinois. Understanding your tax bill Where to get answers.

Real PropertyTax Service AgencyPutnam County New York. House Number Low House Number High. Home Shopping Cart Checkout.

Putnam County Property Tax Facts. This can be found on your tax bill that was mailed to you from the Putnam. Other duties of this office include issuing titles.

Unpaid tangible personal property accounts begin accruing interest at a rate of 1 ½ per month. Ad Pay Your Taxes Bill Online with doxo. Tax Collection Budgeting Accounts Receivable and Payable Payroll Producing Financial Statements and Information.

These are deducted from. Each November 1st the Tax Collector opens the tax rolls and mails tax bills to the owner of record from the beginning of the calendar year. The Town of Putnam uses Invoice Cloud for anyone choosing to pay their real estate business personal property or motor vehicle tax payments with credit card debit card savings account.

Putnam County Property Tax Inquiry

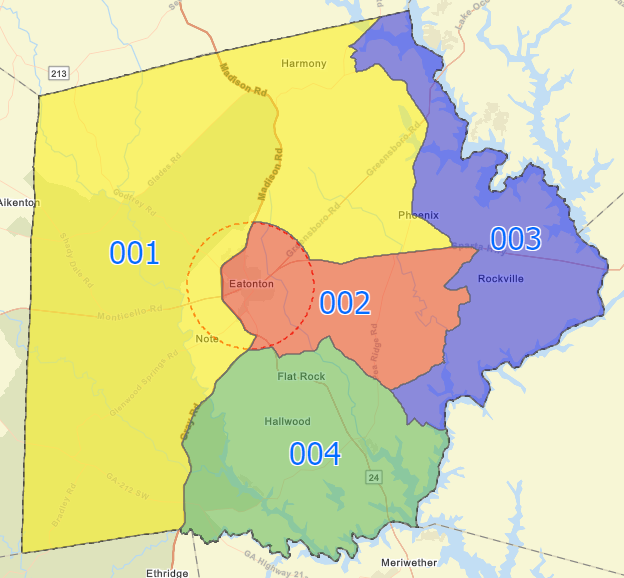

Board Of Commissioners Putnam County Georgia

Putnam County Ohio Tax Map Department

Press Releases For County Executive Archives Putnam County Online

Putnam County Ohio Tax Map Department

Putnam County Florida Property Search And Interactive Gis Map

Putnam County Tax Assessor S Office

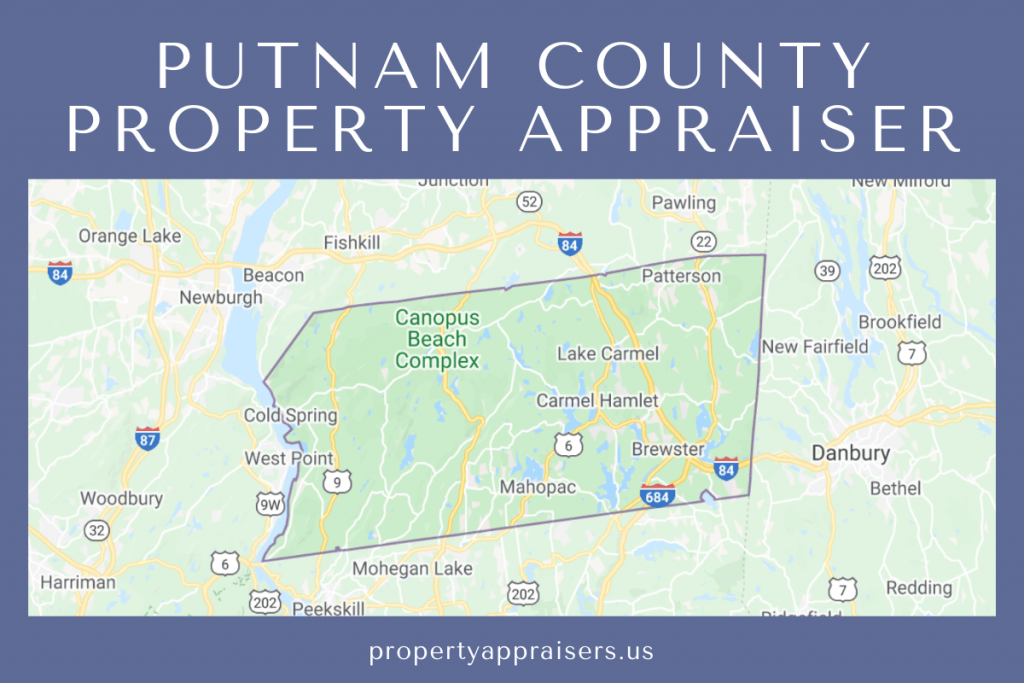

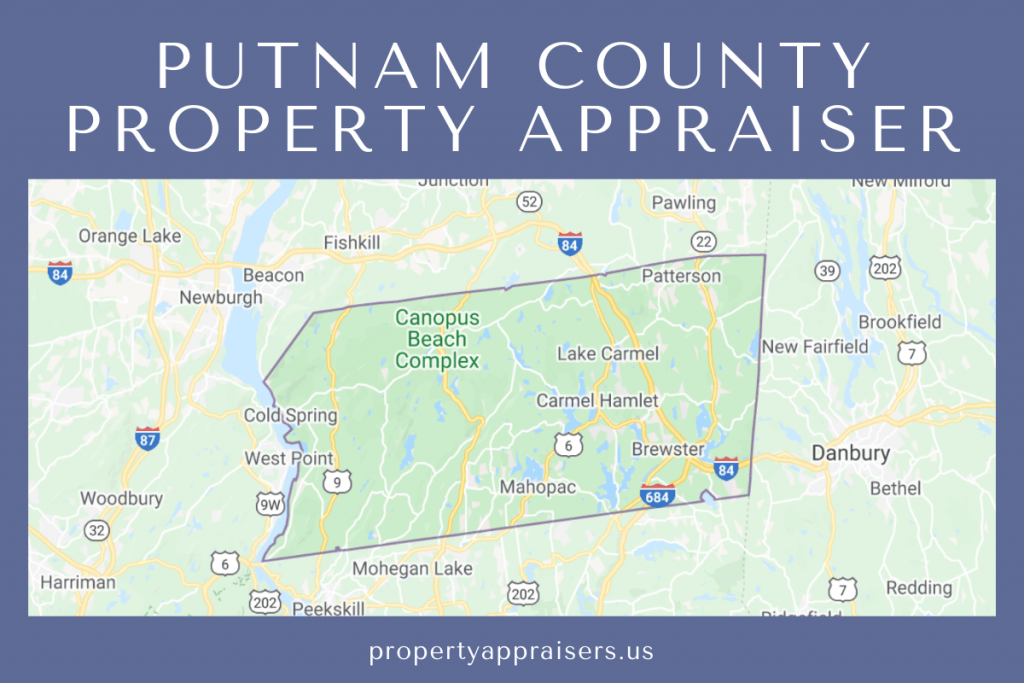

Putnam County Property Appraiser How To Check Your Property S Value

Property Appraiser Putnam County Florida

Putnam County Tax Assessor S Office

Putnam County Assessor Frequently Asked Questions

Basketball Champs Putnam County Georgia

Putnam County Ny Tax Foreclosed Real Estate Auction Home Facebook